From Blissful Ignorance to Awakened Understanding

I’ll admit, I used to have very little interest or understanding when it came to the economy. Money was just an unfortunate necessity, a tool used by the wealthy to oppress the poor, or so I thought. That all changed a few years ago when Maciek introduced me to the fascinating world of economics. By patiently explaining numerous insightful principles and answering my questions, he significantly broadened my perspective and made me realize just how little I truly understood about the complex realities that underpin our modern financial system.

Today, I will delve into the insights provided by the “Hidden Secrets of Money” series from renowned precious metals expert Mike Maloney. This in-depth exploration will focus on the critical distinction between true money and the impostor known as fiat currency. By understanding this fundamental difference and the role they play in the economy, we can gain a deeper appreciation for the systemic monetary issues that have plagued civilizations throughout history.

With this said, let’s dive in this week’s blog article!

The Fundamental Divide Between Money and Fiat Currency

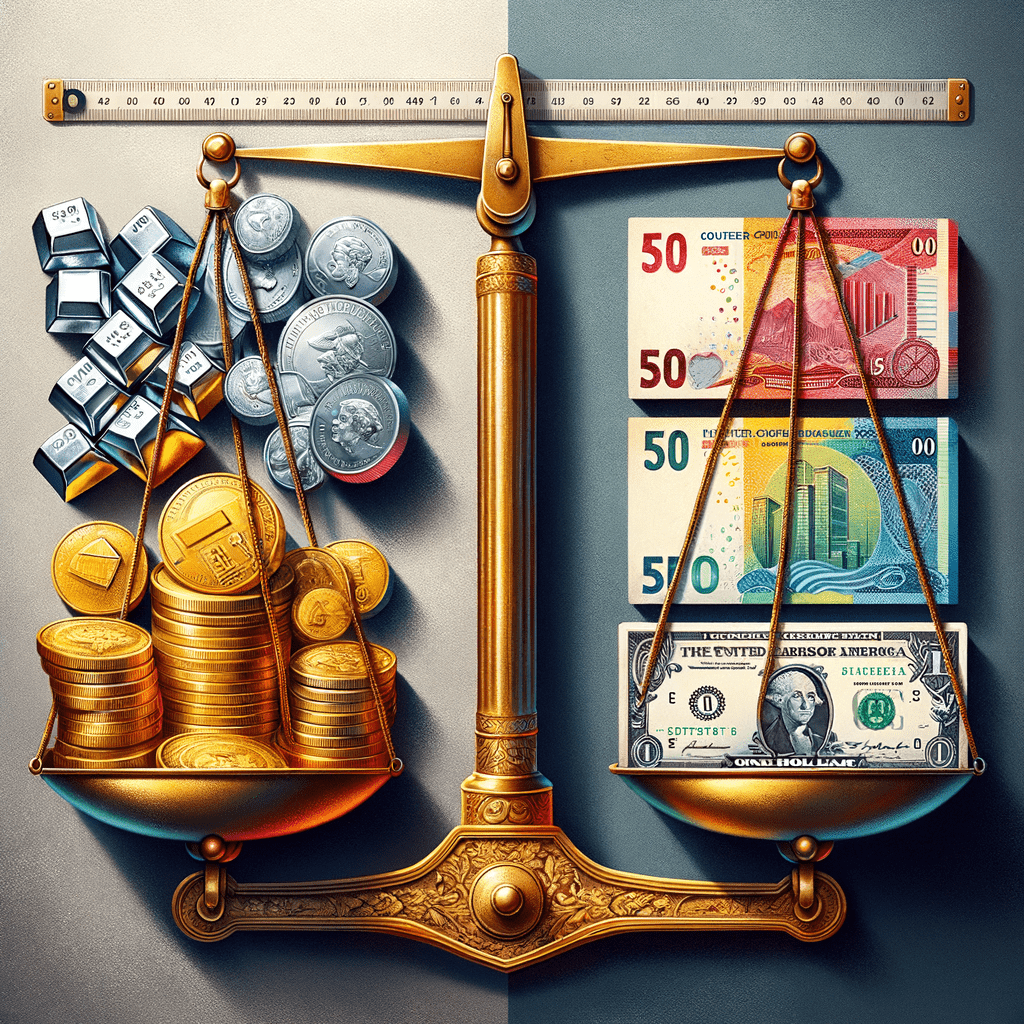

Mike Maloney, the renowned precious metals investment expert and founder of GoldSilver.com, begins his exploration by shedding light on the critical distinction between true money and the impostor known as fiat currency. He challenges the public’s muddled understanding of this fundamental separation, setting the stage for a comprehensive journey through the systemic monetary issues that have plagued civilizations throughout history.

To illustrate this divide, let’s make a simple question: “Which of these is not like the other – a pile of Monopoly money, a stack of dollar bills, or a gold coin?” The answer seems obvious to a group of children, who would quickly identify the gold coin as the unique item, intuitively grasping the difference between money and currency.

However, present the same question to a room full of Ivy League professors and graduate students, and their responses may surprise you. Many would argue that the dollar bills, being a legitimate form of legal tender, are the ones that stand apart. This perplexing blindspot reveals a significant gap in the understanding of these highly educated individuals, who have been steeped in the dominant paradigm of fiat currency.

The children’s clear-sighted perspective serves as a stark reminder that sometimes the simplest truths can be obscured by the complexity of our educational and professional training. To truly understand the difference between money and currency, we must journey back to the rich history of human civilization, unearthing the origins of this fundamental.

The Origins of True Money

Journey back to ancient Egypt, where the roots of our modern monetary system can be found. Approximately 5,000 years ago, the Egyptians began using gold and silver as their predominant form of currency. However, these precious metals were not yet true money, as they were of varying sizes, weights, and purities, making trade and the establishment of prices a challenging endeavor.

It was not until the development of standardized coinage that the concept of money, as we understand it today, truly emerged. These uniform pieces of precious metal, minted with the authority of the ruling power, provided a reliable and easily recognizable medium of exchange, revolutionizing economic activity.

What is remarkable about the Egyptian use of gold and silver is their remarkable longevity. The very same precious metals that the Egyptians employed in their daily trade are still with us today, having maintained their purchasing power over the millennia. This durability is a testament to the inherent qualities of true money: divisibility, portability, scarcity, and the ability to store value over extended periods.

The Rise of Fiat Currency and the Erosion of Understanding

In contrast, the paper currencies that have become the dominant form of money in the modern world lack these essential attributes. The ease with which governments and central banks can manipulate and devalue these fiat currencies has led to a gradual erosion of the public’s understanding of true money.

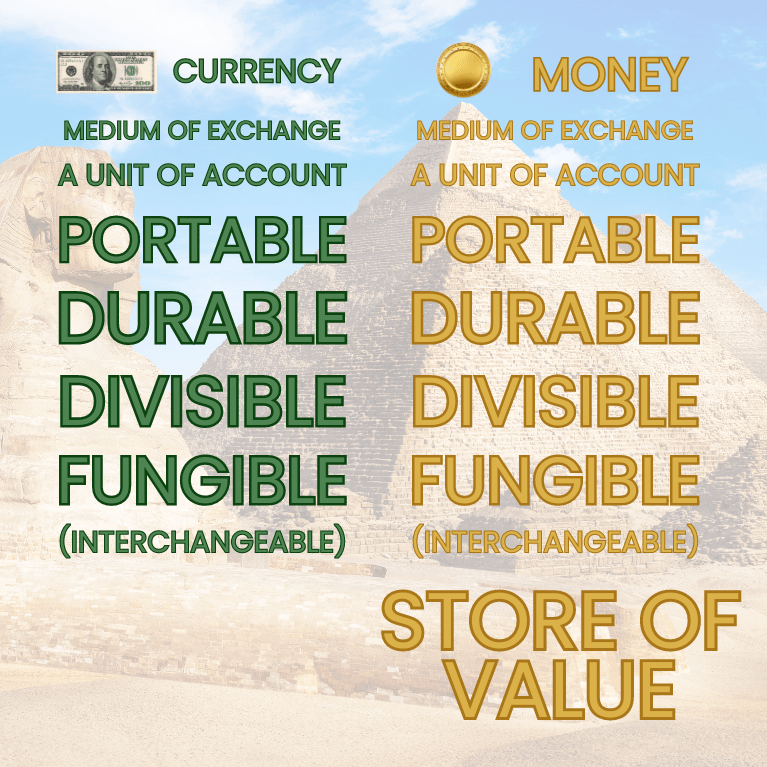

Maloney states that one of the reasons we are in such a financial mess is that today, globally, people do not understand the difference between currency and money. Currency is a medium of exchange, a unit of account, portable, durable, divisible, and fungible (interchangeable, so each unit is the same as the next unit). Money, on the other hand, is all of those things plus a store of value over a long period of time.

Precious Metals: Anchoring Real Value Through the Cyclical Collapse of Fiat Currencies

The enduring value of gold and silver can be traced to a fundamental characteristic – their quantities, while not fully fixed, are extremely difficult to increase significantly. Gold and silver cannot simply be created out of thin air like fiat currency. As Richard Daughty of the Smith Consulting Group aptly reminds us, currencies that are not backed by real, tangible assets like precious metals have a 100% historical failure rate, eventually collapsing to zero value.

In the past, many currencies were directly convertible into gold or silver, deriving their worth from the scarcity of these metals. However, the reality today is quite different. Most modern currencies are fiat money (not real money), existing solely by the decree or “fiat” of the government. The historical context behind this shift will be explored in future articles.

Fiat currencies, with their worthless paper substrates, are issued by governments wielding the power of the printing press. Central banks then give this paper the official “stamp of approval,” transforming it into circulating currency. However, this transformation is an illusion, as central banks will readily admit that there is no intrinsic value in this ‘money’ – its worth exists solely on the fragile foundation of public confidence. The foundation of fiat currencies like the US Dollar was originally built on sound money, such as gold. But this link to true monetary value has long since been severed.

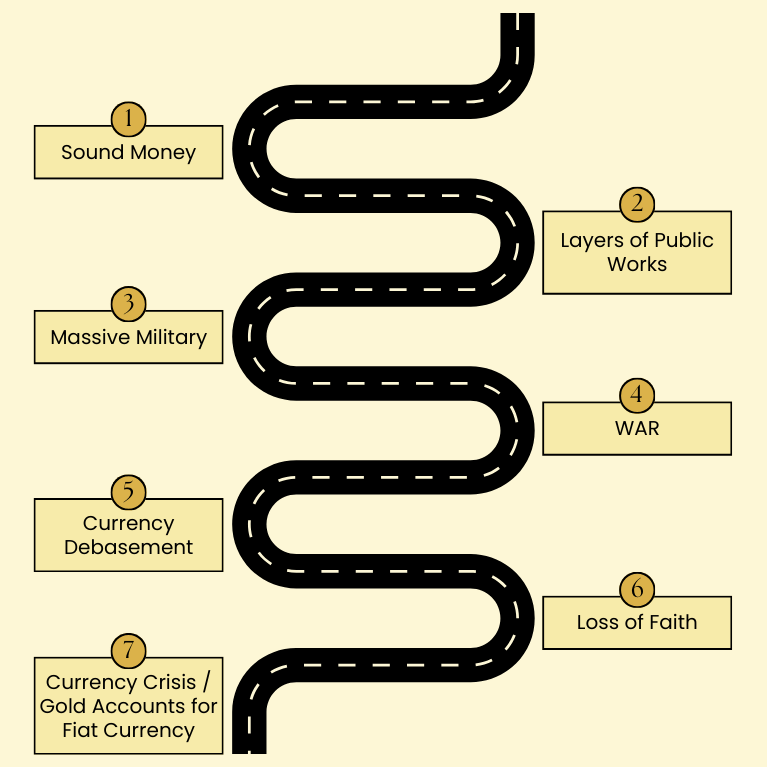

The reason for this transition is rooted in a cyclical pattern observed throughout history. Governments and central banks operate today in much the same way as ancient civilizations, such as the renowned Athenian empire. Maloney likens this pattern to the “7 Stages of Empire”:

This historical trajectory, which ultimately led to the downfall of great civilizations, is now playing out with modern governments and central banks repeatedly resorting to devaluing their currencies due to the demands of war, public works, and deficit spending.

Can you think which stage we are currently in nowadays?

The Lessons of History: The Fate of Unbacked Currencies

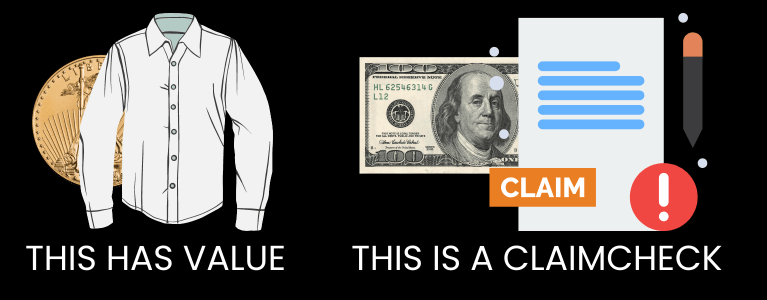

Maloney explains very clearly where the dollars, or those pieces of paper, originated from. Before World War I, he explains, the U.S. Treasury would issue notes stating a certain amount of gold coin had been deposited and was payable to the bearer upon demand. The money was physically held in the vault, and the currency was merely a “claim check” – not money itself, but rather a piece of paper representing the ownership of the actual gold.

This is a crucial distinction, as true money must function as a store of value, maintaining its purchasing power over long periods of time. However, governments and financial entities have a tendency to stray from this principle, printing money in excess and thereby lowering its value and eroding the public’s purchasing power. This devaluation of the currency is akin to the dry cleaner giving you a claim check for your shirt – the check does not store value on its own, it simply represents the underlying asset (in this case, the gold) that is being safeguarded.

Inflation and Deflation: The Consequences of Manipulating the Currency Supply

Maloney uses Milton Friedman’s definition of inflation and deflation. Inflation is an expansion of the currency supply, while deflation is the contraction of the currency supply. If you expand the currency supply, eventually prices will rise, and they will go down if you contract the currency supply.

To further illustrate this concept, I will provide the following example that I think may help to grasp the concept of deficit spending and inflation. Imagine there is a pool of $5, which we can consider to have some intrinsic value, even though most modern currencies are not backed by tangible assets. If you add another $5 created out of thin air, now you have $10 with the value of only $5. This means each dollar has a value of $0.50, effectively devaluing the currency by half. You can keep adding more supply, but the underlying value remains the same, leading to a continuous devaluation of the currency.

Maloney also draws a parallel to the ancient Athenian civilization, where a similar dynamic played out. In the 7th century BC, Athens had established a system of exchange using silver and gold coins, which facilitated the development of free markets. However, when Athens found itself in a war with Sparta, it needed to finance the conflict. Unable to access its silver and gold mines, Athens resorted to deficit spending. Let’s take the example of taking 1,000 gold coins in taxes and then melting those coins, creating 2,000 new coins by mixing the gold with 50% copper. This debasement of the coinage has the same effect as the unbacked currency creation seen today. This operation was carried out in the Athenian empire, causing the devaluation of the currency, leading to inflation and eventual collapse.

This concept of deficit spending, where governments and financial entities create additional money supply not backed by real value, is exactly what is happening in modern times. Governments are printing money out of thin air, just as the ancient Athenians did by debasing their coinage. The result is the devaluation of the fiat currency, which is no longer true money with intrinsic value.

Even though the Athenian currency was still partially backed by precious metals, the debasement of the coinage by mixing in cheaper metals had the same effect as the unbacked currency creation seen today. The purchasing power of the people was eroded, and the once-prosperous Athenian civilization succumbed to the consequences of manipulating the currency supply.

Maloney highlights the alarming trajectory of modern fiat currencies, using the US dollar as a prime example. He notes that it took over 200 years for the total US dollar supply to reach just $825 billion. However, in recent decades, this figure has increased dramatically due to government deficit spending and programs such as bailouts and Quantitative Easing (QE).

Bailouts refer to the government providing loans or funding to prop up struggling companies or industries, preventing them from defaulting on their debts. Quantitative Easing (QE) is when the central bank injects more money into the financial system by purchasing assets like government bonds. Both of these measures involve the creation or distribution of additional debt in the economy, with the goal of preventing economic collapse and stimulating growth, though the long-term implications can be complex.

As I delve deeper, I’m left unsettled. These policies merely postpone the inevitable, worsening the situation long-term. The parallels to the Athenian empire’s downfall are hard to ignore, and fiat currency’s demise appears imminent. Have you heard of the digital currency? Scary, isn’t it? But that’s material for another blog article …

Conclusion: Reclaiming the True Meaning of Money

And we got to the end. Let’s revise the KEY takeaways we have learned:

- The fundamental distinction between true money, exemplified by precious metals like gold and silver, and the fiat currencies manipulated by governments and central banks

- The alarming historical patterns of currency debasement and the cyclical collapse of empires, which are now playing out on a global scale

- The urgent need to restore a genuine understanding of money and its essential qualities as a store of value, rather than merely a medium of exchange

- The important role that precious metals can play in anchoring real wealth amidst the inevitable downfall of unbacked fiat currencies

Many investors allocate a portion of their surplus funds into precious metals, commodities, and other tangible assets. They recognize the inherent value and ability of these assets to maintain purchasing power over time.

In articles to come, we will delve deeper into this rabbit hole, further understanding the money-fiat currencies historical relationship, how the financial system works, the machinations of central banks, and much more.

I encourage you to share your thoughts and insights in the comments below. What are your thoughts? What is the most shocking thing you have learned from here? Can you tell now you clearly understand the difference between money and fiat currency?