Beyond Multiple Streams: Unveiling True Wealth Drivers

Wealth is a key component of financial freedom that can liberate anyone who decides to pursue that path. You’ve likely encountered influencers promoting the idea that generating multiple streams of revenue is the way to go. But is it really?

Our blog hasn’t seen the growth we hoped for, as its early stages of growth. Despite our efforts, our digital presence is just incrementally developing and our social media engagement is slowly steadily building. The process has been both challenging and incredibly rewarding in unexpected ways. The discipline required to maintain a schedule and produce content has improved my organizational skills and overall life satisfaction, thanks to more frequent writing and reflection.

Though our stats are not extremely encouraging, the skills and personal growth we’ve gained are invaluable. We’re not giving up, but we recognize the need for a strategic pivot that has yet to be defined.

One thing is certain: pursuing a passion and side hustle, like this blog, can lead to income diversification to build long-lasting wealth, making us freer in the long run. However, I’ve learned about some caveats that have both challenged and solidified my conventional understanding of wealth building. Are you intrigued? If so, please read on.

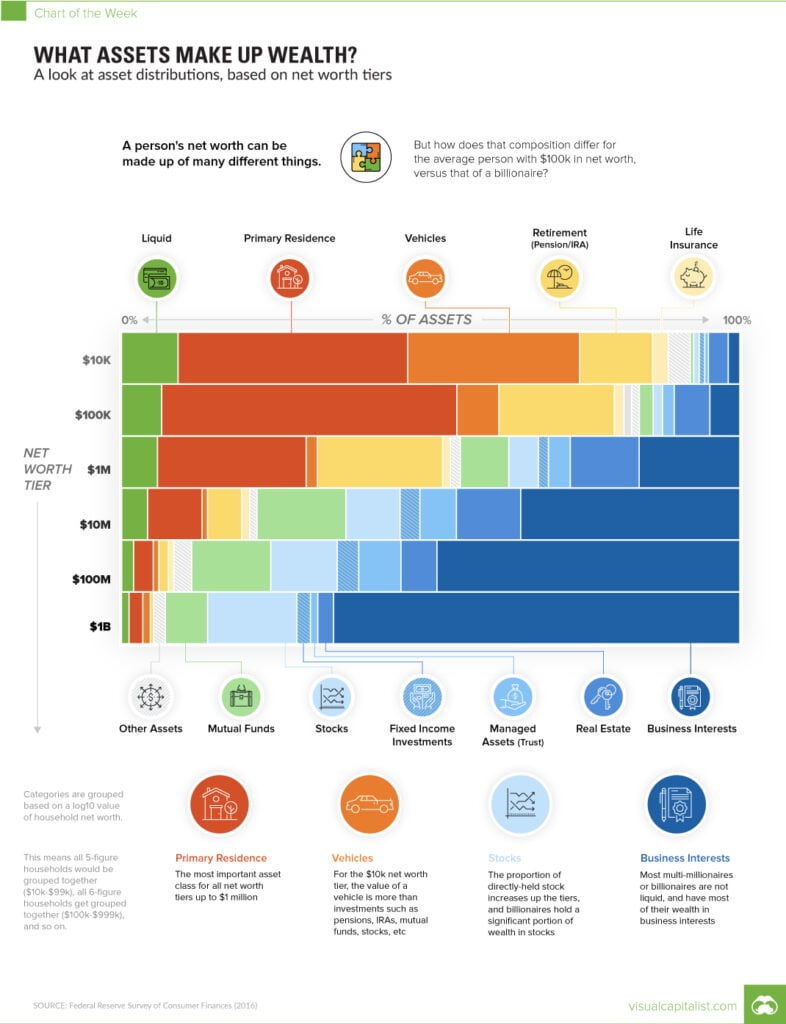

Decoding Asset Distribution: A Glimpse into Wealth Brackets

The notion of a business being the ultimate vehicle to financial success seemed very intuitive. However, it’s potentially not the exclusive path to wealth, as you’ll soon discover.

The image provides an interesting look at how the composition of assets differs for individuals at different levels of net worth. Even though the data is over 5 years old, the insights are likely still valid.

For those with a net worth of $10,000, the majority of their assets are in liquid form, likely representing cash, savings, and checking accounts. As net worth increases, the proportion of assets shifts, with primary residence becoming a more significant component for those in the $100,000 to $1 million net worth range. Investment assets such as stocks, mutual funds, and fixed-income investments grow in importance as net worth increases further, eventually making up the largest share of assets for those in the $100 million to $1 billion net worth tier.

In a nutshell, wealthy people often own businesses, but they also diversify into other “wealth baskets” for protection and long-term growth. Businesses usually can scale and return far more money than any other investment, but a balanced portfolio is essential for mitigating risk and maximizing returns.

Shattering Myths: Scott Galloway’s Unconventional Wisdom

A recent interview with Professor Scott Galloway on the “Diary of a CEO” YouTube channel has challenged my views. Even though he was promoting his new book, Galloway shared several insights that made me rethink my career and approach to success.

For reference, he talks about a recipe for a potential “baller” dreaming of a lavish life, not necessarily for an average person. Yet, as always, there’s a useful perspective in it.

The Passion Paradox: Mastery Before Fulfillment?

Galloway challenged the common advice to “follow your passion.” According to him, passion often follows mastery. By becoming highly skilled at something, even if it’s not your initial passion, you can achieve financial success and eventually find enjoyment in your work.

He illustrated this point with an example of a highly successful soapstone installer earning over $1,000,000 per year, who surely dreamed of becoming a football star rather than a stone worker for wealthy clients. This shows how mastery in a niche field can lead to both financial success and personal satisfaction, even if it wasn’t someone’s childhood dream.

Do you resonate with this idea? Have you found passion in an unexpected field?

The Power of Focus: One Main Hustle to Rule Them All

Galloway emphasized that having too many side hustles might indicate that your main hustle isn’t working. While this isn’t entirely my case, it made me reflect on the importance of focusing on what truly drives success.

As he put it straightforwardly:

“Focus. Go all in on something. Once you find something you’re really good at, that you could be in the top 1% at…go all in on it.”

Aiming High: The 1% Advantage in Wealth Creation

The key is to identify an area where you can excel and that also has strong employment prospects. Aim to be in the top 1% of your field. However, Galloway notes that even being in the top 10% can lead to a decent and fulfilling life.

This perspective struck me as I recently realized that while striving for excellence at my job, I am in a leadership level that is in the top 5% of the company. This realization has fueled my motivation to continuously learn, grow, and push my boundaries.

Corporate Climb vs. Entrepreneurial Leap: Choosing Your Path

Surprisingly, Galloway highlighted that corporate America has provided a comfortable life for many high-performing individuals. So aiming to be in the top 1% in your field, whether in a corporate setting or as an entrepreneur, can lead to significant rewards.

While entrepreneurship can lead to faster wealth creation and a more lavish lifestyle due to its advantages in speed to capitalize on opportunities, leverage, and more control over growth direction. On the other hand, the corporate route requires more time and strategic investment, such as in low-cost ETF index funds. If you follow the corporate route, you’ll need to force your savings and leverage compound interest by investing early on.

Charting Your Course: Navigating the Road to Financial Freedom

There is much more to learn from Professor Scott Galloway, and I think he convinced me to buy his book. I certainly recommend at least watching that interview.

In conclusion, the path to wealth creation is multifaceted. Whether you choose entrepreneurship or a corporate career, the key lies in excelling in your chosen field, focusing on your main hustle, and making strategic financial decisions. Remember that passion often follows mastery, and being in the top percentile of your profession can lead to significant rewards.

As we continue our journey towards financial freedom, let’s keep these insights in mind and strive for excellence in our chosen paths. The road may be challenging, but with the right mindset and strategies, we can build lasting wealth and achieve our financial goals.

What are your thoughts on Galloway’s advice? Share your experiences and insights in the comments below!