Unveiling the Reality

Do you tend to form an opinion based on headlines alone, without reading the full article? Have you ever encountered someone like that (if you don’t want to admit your own vices)? Do you think it was by accident?

Perception is a powerful force that shapes our understanding of the world. The media plays an influential role in shaping public perception, though the incentives are not always aligned with portraying the full truth. As we stand on the precipice of a potential recession in 2024, it is worth looking past the sensational headlines to understand the facts and figures behind economic cycles.

Recessions are formally defined in retrospect, but leading indicators often telegraph trouble ahead. Unemployment, for instance, is considered a lagging indicator that only spikes after an economic downturn is already underway. Leading indicators like growing credit card debt and declining consumer spending, however, can signal challenging times before they become widespread.

In this article, we will explore the data and metrics that provide objective insight into the state of the economy. The goal is to unveil the reality behind the looming recession, away from the pink-tinted glasses of mass media perception. The lure of compelling headlines fades when we shine the light of truth through careful examination of economic fundamentals. By going beyond the hype, we can empower ourselves with knowledge to prepare for what may come.

The world is a complex beast, so let’s look into the details of how it all can play out in the near future.

What is an Economic Recession?

I f you follow our articles, you will figure out that we like to set up the scene with first things first — the definitions. A recession is an economical downturn lasting for at least two consecutive quarters. It can be measured as the prolonged negative Gross Domestic Product (GDP) of an economy. More complex formulas can be found as well; however, all they try to do is fine-tune them to make it more eloquently and evident that economic activity has slowed down.

f you follow our articles, you will figure out that we like to set up the scene with first things first — the definitions. A recession is an economical downturn lasting for at least two consecutive quarters. It can be measured as the prolonged negative Gross Domestic Product (GDP) of an economy. More complex formulas can be found as well; however, all they try to do is fine-tune them to make it more eloquently and evident that economic activity has slowed down.

Economic activity, in a broad context, refers to the production and exchange of both goods and services. Let’s list some examples of trade activities such as: our purchase of more fashionable clothes; holidays or travel; takeaways and subscription services like Netflix; investments at both personal and business levels, such as investing in stocks or in new ventures or equipment. So it is almost all that we do as humans, one way or another, accounts for the exchange of monies.

For the majority of the population, a recession can have a number of negative consequences. Due to the downturn, companies sell less than they used to, yielding less revenue, directly impacting profits and forcing them to cut spendings. Since employment is one of the most expensive expenses, naturally, to survive, wages are reduced and/or the number of hired staff. That can also come with the rise of prices to keep the balance sheets of those businesses in check. That obviously further contributes to making goods less affordable, which further exuberate the bleak situation. If such a downward spiral of recession lasts for too long, it can lead to economic depression, which governments are so afraid of. Remember that recessions can have indirect effects on people’s lives, such as increased crime, social unrest, and mental health issues. Depressions can lead to chaos and a loss of power.

Hey, but don’t worry! Everything in the universe is always a part of some sort of cycle. From season changes, moon movement, the growth, and fall of empires, even down to climate changes or our human lives. Some here stipulate that such a downturn in economics is part of the so-called business cycle, of bust and boom, which, by the way, was studied extensively in the past. Nevertheless, for me, recession is rather a phase of a complex self-stabilizing system of highly interconnected inputs and outputs with multiple feedback loops; for some people, this is just called the economy.

The Emotional Creatures: Shaping Perception, Shaping Reality

We are emotional creatures, prone to romanticizing and dramatizing situations. In times of prosperity, we strategize and plan, but in times of stress, we panic and overreact. As individuals, we are actors in the economy, often unaware of our impact on it. Moreover, we fail to recognize that the economy, like any natural system, is self-regulating and tends to return to equilibrium. Recessions, in this sense, are like a “restart button” in a computer that restores everything back to balance.

Keynes and Perception Management

The “everything bubble” and amplified risks of the current recession can be traced back to economist John Maynard Keynes. In the nutshell, he advocated for governmental interventionism and market manipulation through fiscal policy to fix the market. His theory has been exploited by governments to justify excessive spending and to manipulate monetary policies. This has led to distorted policies that serve their own interests, similarly to a drug addict’s justifications despite negative consequences.

However, Keynes also understood a fundamental truth about economics — that perception shapes reality. Human psychology is inextricably linked to economic performance. Therefore, don’t shoot the messenger, let’s acknowledge these positive contributions to classical economic theories.

Animal Spirits and Economic Fluctuations

This notion manifests through the concept of “animal spirits” — the unpredictable, emotional factors that influence human decision-making. Rendering people emotional and non-rational actors in the economy is contrary to what was previously established. When uncertainty arises, people become more cautious, leading to declines in consumer confidence, spending, and overall economic activity.

Governments and institutions leverage this relationship by managing public perception. Controlling the narrative allows them to calm fears and maintain stability, at least superficially. We witnessed this during the pandemic, with messaging designed to “flatten the curve” and prevent panic, as otherwise uncertainty would exacerbate negative outcomes.

The Limits of Perception Management

However, the looming recession exposes the limits of perception management. While cheap credit and stimulus policies may have kept zombie companies afloat, fundamental weaknesses in the economy persist. Reality eventually catches up.

Despite optimistic headlines, critical indicators are flashing red. Debt bubbles swell as increased interest rates only expose excessive leverage that led to the recent bank collapse, i.e. Silicon Valley Bank. Supply chain disruptions and inflation disrupt business operations. Consumers face a cost-of-living crisis, with their buying power shrinking.

Actions speak louder than words. Despite the rosy headlines, concrete evidence points to an economy on the precipice. In subsequent sections, we will analyze data that reveals the truth about the current economic situation. First, however, we will explore how recessions are defined, and the tools used to identify them. This context will help us evaluate the indicators that truly matter.

The Looming Recession: A Deeper Look at the Warning Signs

Let’s get to the meat immediately, without further ado. Remember that we live in the United Kingdom (UK); however, we will cover a mix of the UK and United States (US) markets. So pay attention to which on I refer, but the overall picture is quite the same. Whether we are off by 1% or 5% is no matter to us here as we look at trends, not fight over the inaccuracies of those metrics or estimates, as we will expose some of them herein and in the next part.

Please keep in mind that the measures we will quote here are from the time of writing this article (4th week of 2024) and will vary with time, yet we will keep the links for your future reference.

The Overall Outlook, Opinion, and Inflation

Let’s turn to the Federal Reserve System (FED) in the US as our source. The FED’s Board of Directors and District Branches produce a report on current economic conditions twice every quarter, known as the Beige Book. This report is based on anecdotal information gathered from interviews with key business representatives.

The overall outlook of the Beige Book from January 2024 shows mixed signals, with some districts reporting growth and others reporting declines. Manufacturing activity decreased in most districts, and concerns about the office market and the election cycle contributed to economic uncertainty. The report also notes that ‘high interest rates’ have limited auto sales and real estate deals. However, these negative factors were somewhat offset by a seasonal uptick in spending due to the end-of-year holiday season. To quantify the sentiment of the publication, I used a technology-based scoring system that resulted in a score of 5/10, which aligns with the mixed outlook presented in the report.

Furthermore, due to the global pandemic event, economies experienced an inflation surge. Let’s park for now the whole debate about what inflation is or not, and any controversy about how accurate it is per each of us, etc. The last readings of the Consumer Price Index (CPI) for December 2023 were 3.9% and 4.2%, US and UK, respectively. Also, according to official statistics, it peaked recently in mid-2022 at 9.1% and 9.6% in the same order. However, if one used the “old way” of measuring inflation, the alternative picture would emerge. Thanks to shadowstats, we could assume that the potential inflation went almost to the 18% mark. Showing us that inflation reached higher levels in the last 50 years than otherwise would not be uncovered.

source: tradingeconomics.com

The main takeaway here is that prices rose quite quickly and quite substantially in the span of the last 20 months. Remember that the inflation metric is a rate of price increase, not an increase itself. The average person’s purchase capability eroded substantially, making some people need to rationalize and prioritize their outgoings.

GDP or GDI?

So any reputable source would frame the recession in a time frame of two consecutive quarters with the addition of a GDP metric. The alternative measure is the Gross Domestic Income (GDI), which, similarly to GDP, is produced in the US by the Bureau of Economic Analysis. Yet, as in the preamble, we mentioned the leading and lagging indicators. We can simplify the whole argument to, depending on when you want to label the recession:

- GDP: post-factum as a lagging indicator

- GDI: pre-factum as a leading indicator

I won’t spend much more time on it here; if you are interested, I recommend reading the FED paper and playing with the first live figure comparing both GDI & GDP with marked recessions. Just keep in mind that the most important fact is that Nalewaik’s assessment used unrevised GDI metrics to highlight its leading properties as advanced notice for policymakers. For those who are more ambitious, I recommend reading other work by Jeremy Nalewaik about this comparison in relation to US output growth or the link to recession.

The key takeaway here is that even though the real GDP change in the US seems to be positive, it bounced back in Q4 2022 from 0.65% to a whopping 3.1% in Q4 2023. On the other hand, the real GDI change for the same time period was flat and went from 0 to -0.1% in the last reading (Q3 2024) using the graph in the publication. For ambitious people, pay attention to the difference between these metrics. During times of crisis, the largest deltas rarely exceed 0.5%; this was the case only during the 2008 global financial crisis, and we’re currently at the 3% mark.

Leading Economic Index (LEI)

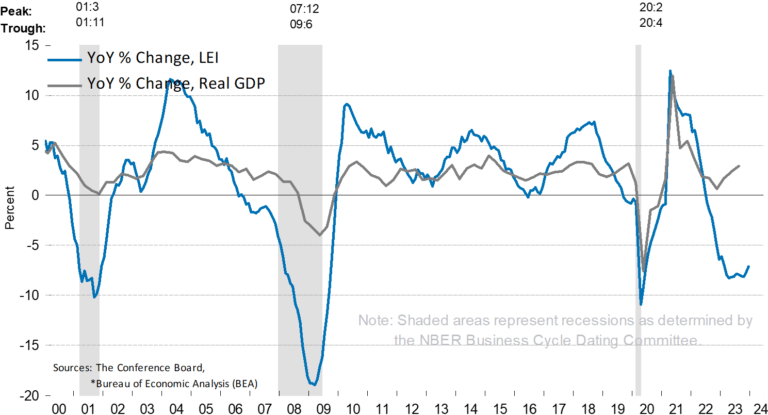

Following the hint of leading indicators, let’s focus on one designed by the over-100-year-old economic think tank, the Conference Board. This non-profit research organization is aspiring to be the world’s leading source of business and economic intelligence. Their work mostly focuses on measuring the business cycle to help leaders navigate through phases of expansion and contraction. One of the main indexes we will focus on is the Leading Economic Index (LEI).

LEI, as they themselves eloquently put it, “provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term”. It aggregates 10 other indexes like money supply, building permits, manufacturing figures, and new orders, just to name some. If you want to learn more, I recommend reading about it on Investopedia.

The main takeaway is that the US economy is not as rosy as it is being painted.

Closing and Summary

The looming recession of 2024 is a complex issue with no easy answers. However, by examining the data and metrics that provide objective insight into the state of the economy, we can uncover some of the underlying realities.

The warning signs are clear: the Federal Reserve has raised interest rates recently very quickly; inflation seems to be tamed, but is it really? The cost of living problems are swept under the rug, when discussing the economy and the Fed’s potential moves. The Leading Economic Index is in negative territory, which presents a completely different picture than the FED tries to paint. While the US GDP is back on track, yet cumulated earnings are going down, touching even a slight point of contraction.

Despite the presented factors not consistently proving my thesis, these trends suggest at least caution for skeptics. The mass media narrative is skewed, again trying to downplay the severity of the situation, but there will likely be a substantial decline in economic activity in the coming months.

We have only scratched the surface, but we will park it here for now. There are many more facts to be raised to clear up the overall picture. In the second part, we will touch on the topics of credit, real estate, and job markets, among others.

Nevertheless, it is important to remember that recessions are a normal part of the business cycle. They are a time of adjustment and renewal, and they can also be a time of opportunity. By understanding the forces that are driving the current recession, we can prepare for the challenges ahead and position ourselves to take advantage of the opportunities that may arise.