As the global economy balances at the edge of falling into a deep recession and financial crisis, of “everything bubble”, the real estate, financial markets, and banking sectors seem to be poised to burst. The impending collapse will undoubtedly have far-reaching consequences, and critics like Edward Dowd are already pointing out radical excuses that would require governments to introduce Universal Basic Income (UBI) that only would work via Central Bank Digital Currencies (CBDCs). But, beneath the surface of these seemingly benevolent measures lies a more sinister reality: a Trojan horse for modern slavery.

In this article, we’ll delve into the world of CBDCs, exploring their implications and potential consequences from a freedom perspective. As we navigate the complexities of this new form of money, we’ll examine how CBDCs might be used to control and manipulate individuals, ultimately threatening the very fabric of our society.

The Basics: So what is Money?

We all use it, and tend to spend countless hours at work to earn our fair share, but rarely do we ask this question. More often than not money is a medium of exchange, a unit of account, and a store of value that allows individuals and businesses to trade goods and services with each other. It serves as a bridge between the present and the future, enabling us to store value now and use it later.

Yurema already wrote an article about the comparison of fiat money to gold, highly recommended. She also mentioned all the qualities of true money namely portability, durability, divisibility, fungibility, and store of value, that I will not dwell on but are important in this consideration.

What is a CBDC and How is it Different?

Before we start let’s talk about the current type of money. Fiat money is a currency that is not backed by any physical commodity, such as gold, silver, or oil, but is instead backed by the government that issued it. Fiat money derives its value from the government’s declaration that it is legal tender – in other words, it is a promise of value because the government said so. We know how this ended in recent years when those very same governments through their loose fiscal policy led to very high inflation.

Thus Central Bank Digital Currency is a digital form of fiat currency issued and controlled by a central bank. On the surface it to similar to commercial bank money, in the sense we know money today. Since would be issued directly by the central bank, it means that can be used directly without needing a bank account.

Surely there are some advantages to this solution, like no need for banks, the convenience of use, and faster and more efficient transactions since fewer parties would be involved.

The Risks of CBDCs: Privacy, Control, and More

- Privacy and Surveillance: CBDCs can be designed to allow governments and central banks to track and monitor all transactions, potentially infringing on individuals’ privacy. This could lead to a loss of financial autonomy and freedom and restrictions at the whim of an authority.

- Control and Censorship: CBDCs could be used to implement capital controls, restrict certain transactions, or even freeze accounts, giving governments and central banks ultimate control over individuals’ financial lives.

- Cybersecurity Risks: CBDCs, like any digital system, are vulnerable to cyber-attacks, which could result in theft, loss of funds, or transaction freeze that could turn into riots.

- Monetary Policy and Inflation: CBDCs could be used to implement negative interest rates, which could lead to a decrease in the value of savings (anti-store of value). They could also be used to inject liquidity into the economy, potentially leading to inflation or disturbance in the economy disincentivizing individuals’ productivity.

- Financial Exclusion: CBDCs might exacerbate existing social and economic inequalities if not designed with accessibility and inclusivity in mind. Also has potential to exclude those who have limited access to internet, elderly people etc.

- Systemic Risk: A CBDC could become a single point of failure, potentially destabilizing the entire financial system if it were to experience technical difficulties or a security breach. This is not a concern in distributed systems (e.g. Bitcoin) or when a physical form of money exists.

- Interoperability and Competition: CBDCs could potentially displace private digital currencies and undermine the competitiveness of commercial banks. Simply monopoly is never a good idea.

What people should understand about CBDCs

CBDCs: Programmable Money

Central Bank Digital Currencies can have conditions and rules built directly into their code. This programmability allows for features like automatic tax collection, expiration dates on stimulus payments, or restrictions on purchasing certain goods. While this offers potential benefits for policy implementation, it also raises concerns about individual freedom and financial autonomy. Governments could potentially use this feature to control spending habits or implement social engineering on a massive scale.

CBDCs: Requires a Digital Identity

To access and use CBDCs, individuals may need to provide extensive personal identification information, potentially linking every transaction to their identity. This requirement could lead to significant privacy concerns, as it would allow for unprecedented levels of financial surveillance. Every purchase, transfer, and financial decision could potentially be tracked and analyzed by governmental bodies or even hackers if the system is compromised.

CBDCs are not a Store of Value

Unlike traditional currencies or certain cryptocurrencies designed to maintain or increase in value, CBDCs might not serve as reliable stores of value over time. Their value could fluctuate based on monetary policy decisions made by central banks/governments. This characteristic might make them less attractive for long-term savings and could potentially lead to rapid devaluation if mismanaged, impacting citizens’ wealth and purchasing power.

CBDCs vs. Cryptocurrencies: Understanding the Difference

While both CBDCs and cryptocurrencies exist in digital form, their underlying principles and structures are vastly different. CBDCs are centralized, issued and controlled by government entities, and typically operate on closed, permissioned networks. In contrast, most cryptocurrencies are decentralized, created and managed by distributed networks, and operate on open, permissionless blockchains. The distributed nature creates an incentive to all participants to maintain the network and its operability, and that makes it extra secure. This fundamental difference impacts aspects such as privacy, censorship resistance, and monetary policy control.

Protecting Yourself in a CBDC World: What Can You Do?

As we’ve explored, Central Bank Digital Currencies (CBDCs) come with a range of risks and challenges that could impact individual freedom, financial autonomy, and privacy. To mitigate these risks, it’s essential to take a proactive approach to protecting yourself and your financial well-being.

Educate Yourself

Stay informed about the development and implementation of CBDCs in your country and region. Understand the design and features of the CBDC, including any programmability, digital identity requirements, and potential risks. Learn also about privacy-enhancing technologies that could help you to better understand the digital world and the risks associated with it.

Diversify Your Assets

Spread your wealth across different asset classes, including traditional currencies, precious metals, and decentralized cryptocurrencies. This diversification can help protect against potential devaluation or manipulation of CBDCs.

Support Alternatives

First of all use more cash, even though paying with your card or smartphone/smartwatch might seem convenient, at first. But if the cash usage is substantial that would make implementation of CBDCs more difficult. Also, consider using decentralized cryptocurrencies and financial systems that operate independently of governments and central banks. These alternatives can provide a hedge against the risks associated with CBDCs.

The Dystopian Potential of CBDCs: Quick Reality Check

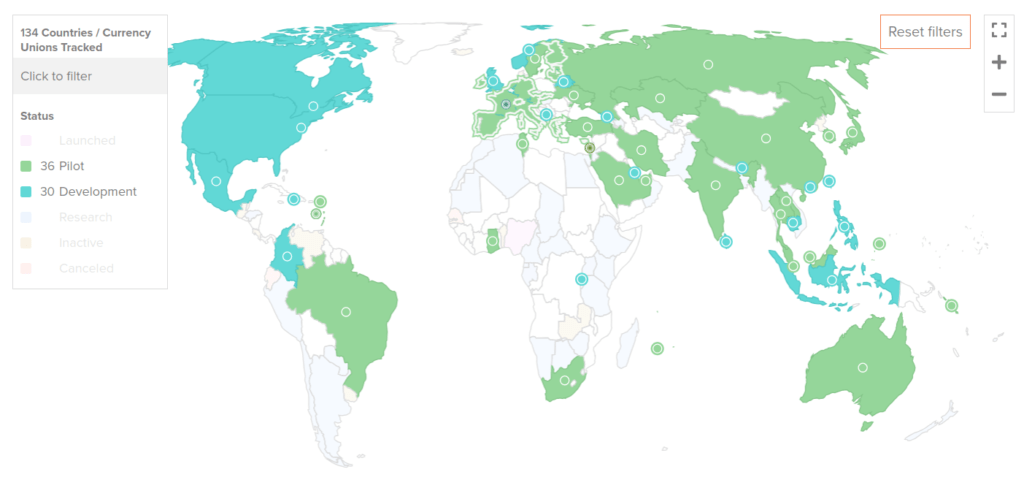

According to the Atlantic Council, “134 countries & currency unions, representing 98% of global GDP, are exploring a CBDC”. The European Central Bank (ECB), for example, is pushing forward with its digital Euro, despite concerns about its potential for control and lack of privacy, aiming to reduce dependence on private payment providers and control digital money.

The dystopian vision of European CBDCs includes limits on holdings (up to €3000), zero privacy, and programmability. There are also plans for the introduction of a European digital ID by 2026, potentially paving the way for a Digital Euro (CBDC) by 2028/2029, as outlined in the Coin Bureau’s comprehensive overview.

Whether we like it or not, it’s crucial to be knowledgeable and prepared for the worst, while hoping for the best. The utopian currency of CBDCs need not become a reality if we take action.

What are your thoughts on the potential implications of CBDCs for our future? Share your opinions and concerns in the comments below!