Introduction

In the previous article of this series, we learned about the fundamentals of money, its difference from fiat currencies, historical facts, and the mechanisms behind inflation and deflation. In this new article, we will continue the previous one with further insights, looking closely at the origin of money circulation, the 140-year evolution of money, and the recurring “Seven Stages of Empire” as outlined by Mike Maloney in the “Hidden Secrets of Money”.

Before delving into the topic, I want to note that we have a wealth of additional content in our Financial Mastery Zone exploring more contemporary economic aspects, mostly produced by Maciek. To better understand the current financial situation and what may be on the horizon, I highly recommend checking out those articles as well. They provide valuable context and analysis that will complement the historical insights covered here.

Empowering you with a deeper understanding of money and finance is a key motivation behind this series. The historical patterns we’ll explore hold profound relevance to the pursuit of financial freedom – a goal that is central to living an empowered life. By arming you with this knowledge, my aim is to help you develop a strong financial arsenal to secure your path ahead.

The Rise and Fall of Athens: Lessons from History

We mentioned in the previous article of this series the financial mechanism Athens put into place that yield inevitably to the collapse of its civilization. Here, we will explore with more details the steps that led to this outcome.

The Origins of Money

The use of gold and silver as money originated in Lydia (modern-day Turkey) around 680-630 BC, where they were minted into standardized coins. These coins then made their way to Athens, the “prototype of democracy” and “cradle of civilization,” where they found their “natural home” in the city’s free markets.

Athens’ Golden Age

Athens was the first society to have a working tax system and free markets, which enabled them to rise to the pinnacle of civilization. This prosperity allowed them to create great works of art, architecture, and engineering that amazed the world even 2,500 years later.

The Athenian Downfall

However, the Athenian downfall began when they got involved in the Peloponnesian War with Sparta. This war led to several economic problems for Athens:

- They lost access to their gold and silver mines.

- Paying their armies far from Athens caused a deflation in the city as their coinage was sent out.

- They resorted to debasing their coinage by mixing in base metals like copper to mint more coins and pay for the war, leading to inflation.

- The expensive public works projects they continued during a brief truce also contributed to their economic woes.

Parallels to Modern Times

What’s happening in Greece right now is basically the same thing that was happening back in 407 BC – the Athenian downfall. The deficit spending to fund all of these public works and the debasement of their currency supply caused them to become nothing but a satellite of Rome. Today, they’re becoming nothing but a satellite of the banks.

This sobering parallel suggests that the mistakes of ancient Athens are far from firmly in the past. In fact, author Mike Maloney draws clear parallels between the economic missteps of the Athenians and the current predicaments faced by many modern governments.

Excessive deficit spending to fund wars and public works, the debasement of currencies through inflationary monetary policies, and the resulting loss of faith in fiat money leading to a flight to precious metals – these are all dynamics that have played out time and time again throughout history. The case of ancient Athens provides a poignant example of how the cyclical nature of empires and currencies can lead to their eventual downfall.

In the final section, we will explore the recurring mechanism that Maloney calls the “Seven Stages of Empire” – the cyclical pattern where quality money is gradually replaced by debased currencies, leading to collapse and a return to sound money.

But first, let’s take a closer look at the last 140 years and understand how fiat currencies, with the US dollar at the center, have become increasingly devalued over time.

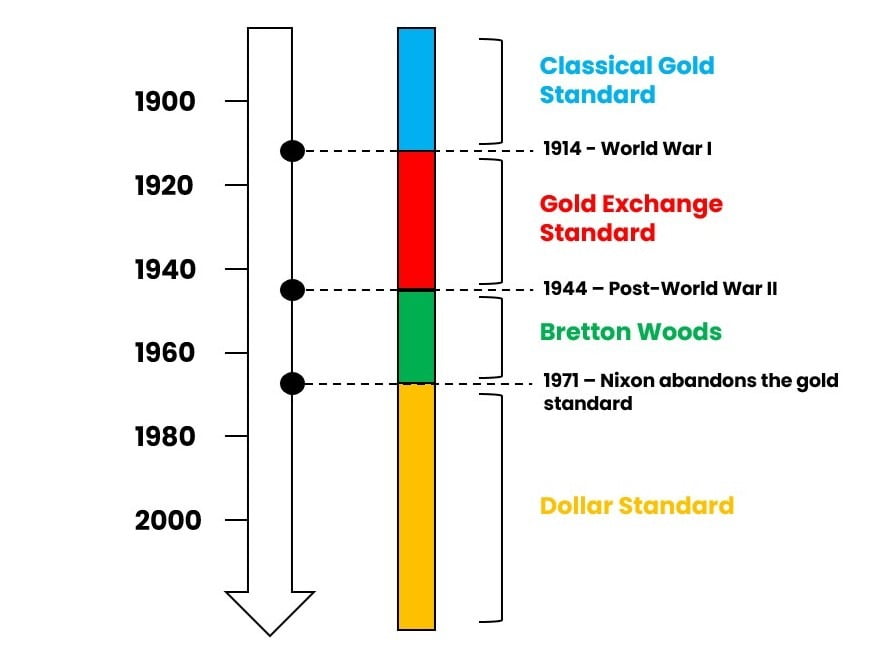

The 140-Year Evolution of Money

The Classical Gold Standard (Before World War I)

The journey begins with the classical gold standard, where currencies were directly convertible into gold held in the vaults of central banks and governments. This provided stability and confidence, as the currency was essentially a “claim check” on the underlying gold reserves. The fixed link between the currency and gold ensured the currency’s value was anchored in a tangible asset.

World War I and the Abandonment of the Gold Standard

During World War I, the major European combatant nations shifted their economies and industries to focus on the war effort, draining their gold reserves as they shipped them to the United States to pay for essential goods. Governments and central banks in Europe and the US began to heavily rely on the printing press to finance their wartime expenditures, marking a fundamental shift away from the classical gold standard.

The Gold Exchange Standard (Between the World Wars)

In the aftermath of World War I, the global monetary system transitioned to a “gold exchange standard,” where currencies were only partially backed by gold reserves, with the US dollar and British pound becoming the main reserve currencies. In the United States, the Federal Reserve Act of 1913 had allowed the Federal Reserve to put $50 worth of currency in circulation backed by only $20 worth of gold (a 40% reserve ratio).

The Bretton Woods System (Post-World War II)

By the end of World War II, the US held two-thirds of the world’s monetary gold reserves, while Europe had none. In 1944, representatives from around the world met at Bretton Woods, New Hampshire and established a new global monetary system, where every currency on the planet (except for a few) was pegged to the US dollar, which in turn was pegged to gold at a fixed rate of $35 per ounce.

The Collapse of the Bretton Woods System and the Rise of Fiat Currencies

Throughout the 1960s, the US continued printing more dollars without sufficient gold backing to support the growing money supply. Other countries, like France under President Charles de Gaulle, started demanding the conversion of their dollar holdings into gold, leading to a run on the US gold reserves. In 1971, President Nixon was forced to abandon the gold standard, marking the end of the Bretton Woods system and the beginning of the era of freely floating, fiat currencies not backed by any physical asset.

The Looming New Monetary System

In summary, the key points, when exploring the time evolution of money, are:

- Currencies have been entirely fiat since 1971, no longer backed by tangible assets like gold.

- Unconstrained money creation by governments and central banks has led to currency debasement and loss of purchasing power.

- This fiat system has made the financial system more vulnerable to inflation, bubbles, and instability.

As we’ve seen from a historical context, the current fiat currency system’s vulnerabilities make it ripe for collapse. Many experts, including author Mike Maloney, believe this will lead to the emergence of a new global monetary system. Maloney envisions this future system potentially being backed by gold, silver, and other precious metals – a return to sound money anchored in tangible assets.

However, as I mentioned previously, there are concerning signs that the transition could instead be towards a centralized digital currency system, as pushed by entities like the European Union. This raises worrying implications that warrant further examination.

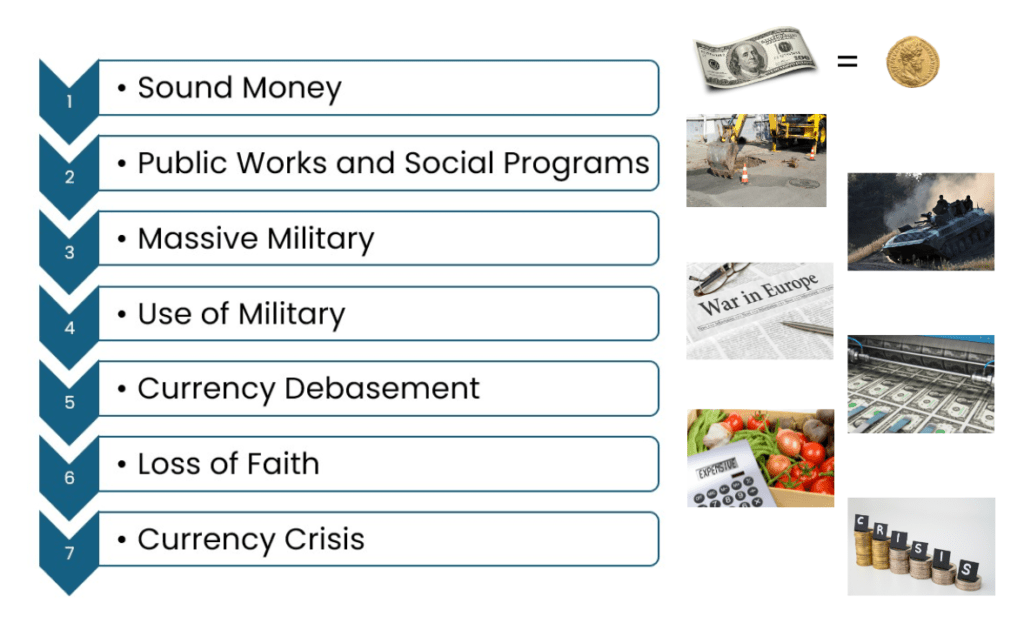

The Seven Stages of Empire

In this final section, we will quickly explore the “Seven Stages of Empire” framework developed by author Mike Maloney. This concise summary explains the cyclical historical pattern where sound money is gradually replaced by debased currencies, leading to collapse and a return to quality money.

Understanding this dynamic is crucial, as it provides important context for comprehending not just the downfall of ancient Athens, but also modern predicaments with fiat currency systems.

The seven stages are as follows:

- Sound Money: The country starts with a sound monetary system, likely based on a commodity like gold or silver.

- Public Works and Social Programs: As the country grows, it begins adding layers of public works projects and social welfare programs, expanding the role and size of government.

- Massive Military: To fund the growing government and social programs, the country builds up a large, powerful military.

- Use of Military: The country then uses this military might, often engaging in wars and conflicts to exert its influence.

- Currency Debasement: To pay for the growing costs of the military and social programs, the country begins debasing its currency, typically by printing more of it.

- Loss of Faith: The debasement of the currency causes people to lose faith in the currency, as its purchasing power erodes.

- Currency Crisis: This loss of faith ultimately leads to a full-blown currency crisis, where the currency collapses. At this point, gold steps in and does an “accounting” – it revalues to reflect the true expansion of the money supply over the previous stages.

As I asked in the previous article… Which stage of Maloney’s ‘Seven Stages of Empire’ do you believe we are currently experiencing?

In my personal opinion, the trends we are observing point to modern economies being firmly entrenched in the latter stages of the “Seven Stages of Empire” – the phases of currency debasement, loss of faith, and impending crisis. For instance, the money supply has nearly doubled in the last 10 years, fueling high inflation, while governments have responded with extensive stimulus and economic interventions. Those who recognize this cycle and prepare accordingly will be far better positioned than those who do not. History suggests the individuals and communities who were able to anticipate and prepare for such systemic changes tended to fare better than those who were caught off guard.

Wrap-up and Conclusions

The key points covered in this article include:

- The rise and fall of ancient Athens provides insights into the cyclical nature of empires and currencies

- The 140-year evolution of money, from gold standard to fiat system, shows increasing currency devaluation

- The “Seven Stages of Empire” framework outlines how sound money is replaced by debased currencies, leading to collapse

- Current trends suggest many modern economies are in the latter stages of this cycle

The historical patterns explored offer critical lessons on the fragility of economic systems. Those who recognize the warning signs may be better prepared.

Stay tuned as we continue the “Hidden Secrets of Money” series with strategies and loads of valuable insights to safeguard our financial future.

What do you foresee for our monetary system? How are you preparing to protect your wealth? Share your thoughts below.