Recession is Here

According to the revised figures for the United Kingdom, it appears that the country has already entered a recession. Hence, I need to adjust my initial plans for a series of articles discussing the potential for a recession. Just in case, here are Part 1 and Part 2. Now that it’s official, we will delve into an analysis of other economies.

First, I will give you an overview of the economic downturn in the UK. After that, we’ll discuss the global economic outlook, including Europe. We’ll also touch briefly on China’s economic situation, but we won’t cover the USA as it requires a separate discussion due to its complexity. Finally, we’ll provide some useful tips on how you can prepare for a recession.

Join me as we explore the economic instabilities that affect our lives, whether we want it or not. So, buckle up, because every recession presents an opportunity for those who are prepared. As we navigate these challenging times, we are building a foundation for our future personal freedom!

UK Leader in the Economic Downturn: Understanding the UK’s Economy and GDP Changes

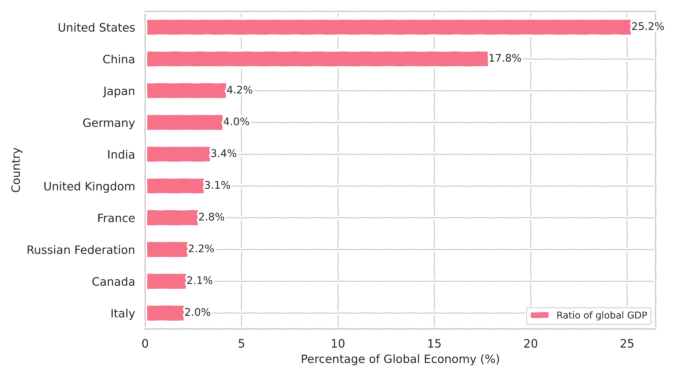

In a global lens, the United Kingdom is the 6th largest economy in the world, contributing approximately 3.1% of global GDP, according to World Bank data dated 2022. The ranking shows that it is slightly smaller by around 0.3% than India (around 3.4%) and it is the 2nd biggest in Europe after Germany (around 4%).

And here it comes, the first estimate of Gross Domestic Product (GDP) changes to -0.3%. The UK is in a technical recession, meaning that the last two-quarter readings of GPD showed a negative value in GDP change. The economic contraction that many had feared. The 2023 figures in all four quarters followed the 0.3%, 0%, -0.1%, and a recent estimate of -0.3%. Pessimistically, the current trend is linearly pointing downwards.

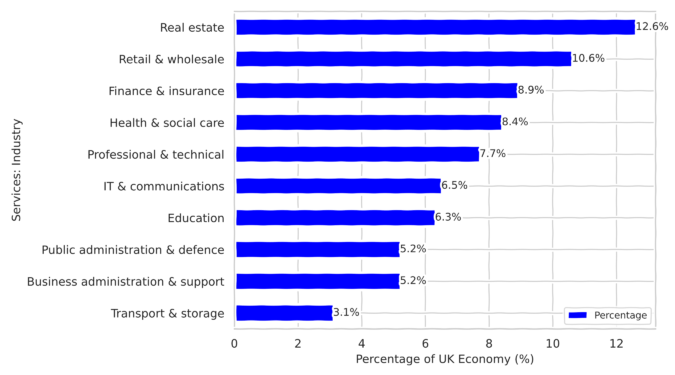

Let’s Understand UK Economy: The Sector’s Distributions

The UK is a services-based economy as it contributes to almost 80% of total GDP output, using 2021 data. The other three largest sectors are Manufacturing 9.8%, Construction 5.9% and Utilities 2.9%. The Mining and Agriculture sectors each account for less than 1%, which likely explains why UK food and natural resources are mostly imported.

So the Services break into smaller categories. Let’s list some of the biggest ones with the percentage of real GDP: Real estate (12.6%), Retail & wholesale (10.6%), Finance & insurance (8.9%), Health & social care (8.4%), Professional & technical (7.7%), IT & communications (6.5%), and Education (6.3%).

An interesting fact is that even Education represents a larger proportion of the UK economy than the entire Construction sector output – if you ever wondered why there are so many international students. Moreover, at the macro scale, it can be noticed that 1/8th of the UK is in real estate (including profits from rents), which is twice more than the whole Construction sector (below 1/16th of the total). But let’s not get too distracted.

Current Culprit

Using an official Office for National Statistics (ONS) report, we can read that even though we are in recession, the overall growth in 2023 is 0.1% compared with 2022. For me, this is a rather grim growth, potentially at the “margin of error,” especially in light of the rising cost of living. The idea of higher spending to get the same or less is not exciting, even if this higher spending “boosts” the economy.

The main culprits for the noted contraction in Q4 2023 are the Services (-0.2%), Production/Manufacturing (-1%), and Construction (-1.3%) sectors. By knowing the approximate sizes, we can quickly conclude that the main driver resides in the Services sector.

In terms of services, 8 out of 14 of the subcategories noted reductions. The biggest hit in Q4 2023 came in ascending order to Wholesale & Retail, Education, Other Services, IT & Communications, and Financial & Insurance activities. Rather, the listed declines were in the chunkier parts of services in the UK economy. Interestingly, Real Estate activities experienced a 0% change; however, in Q3 2023, they were the second-biggest driver for the drop in GDP in the Services category. Mind, they also correspond to 1/8th of total output.

UK Services: Current State and Future Forecasting

Reading between the lines of the GDP ONS report, we can speculate a bit about the future.

The Bank of England’s decision to increase interest rates to control inflation has had a ripple effect on the UK economy. The move aimed to reduce overall spending and the velocity of money, which it did by looking at the deep in Wholesale & Retail sectors. But it has also led to a higher cost of living and a significant impact on the real estate sector.

Impact on the Real Estate Sector

The increased interest rates have notably reduced the activities of the real estate sector. The impact has been particularly severe for those with low-interest rate mortgages, including landlords with buy-to-let mortgages. These landlords have seen their already slim margins erode, forcing them to increase rents for existing tenants. In our case, a landlord demanded a 25% increase in rent.

Once we touched on mortgages, as reported by Bloomberg about over 760k mortgage payers whose sub-2.5% fixed rates end this year might face an increase 40-50% in their monthly payments. Although this group doesn’t represent a significant portion of the overall UK population, this development may still hinder further recovery in people’s spending.

Reduced Consumer Confidence

The impact of the increased interest rates extends beyond the real estate sector. The latest GDP ONS report shows a decline in growth of 0.6% for total services, suggesting reduced consumer confidence or even reduced spending power. This trend aligns with the recent massive increase in the cost of living.

Moreover, the Q4 figures typically include the festive season sales that should boost sales volumes. However, the Retail Sales report for December 2023 showed negative values for both sales value and sales volume indicators on a month-to-month and quarter-to-quarter basis.

Grim Outlook for the Next Quarter

The outlook for the next quarter is grim, with revisions to monthly data GDP and industry figures revised down. Reduced sales data support the outlook of diminished customer confidence metrics. If goods become more expensive, essential spending can erode average disposable incomes, leading to less frugal spending.

Low Response Rate in GDP Report

It is worth noting that the GDP report is based on business survey responses, and the answer rate was just over 80%. This response rate is significantly lower than the same period in 2022, which was 97%. This discrepancy could mean that future revisions might impact the estimated figures as more data is collected.

Grim Global Perspective: Are We Heading for a Global Recession?

Let’s simplify and focus on official readings to gain insights into what might be happening at scale. Keep in mind that we live in a global, interconnected world, and significant economic hiccups elsewhere will not go unnoticed. While Gross Domestic Income would be a better measure of what’s happening behind the scenes, it’s harder to obtain. Did you know that according to World Bank data, the top 20 countries in terms of GDP size (using 2022 readings) account for 80% of global economic output?

World’s Top 20 Economies

So, let’s use the tracking list of G20 (24 economic zones) and peek into their recent GDP changes. We can find that 20% of them, in their last readings, are experiencing negative value growth. That includes South Africa (-0.2%), Canada (-0.3%), and Germany (-0.3%). However, only the UK and Japan are technically in recession, as they have had 2 consecutive quarters in a negative field.

When x-raying Canada, their GDP change in 2023 for the last 3 reported quarters moved in steps of 0.3%, starting from 0.6% in Q1 to 0.3% in Q2, finally going to a -0.3% change in Q3. The trend seems consistently downwards suggesting potential for a recession. Yet at the time of writing, there is no official number for GDP change in Q4 2023.

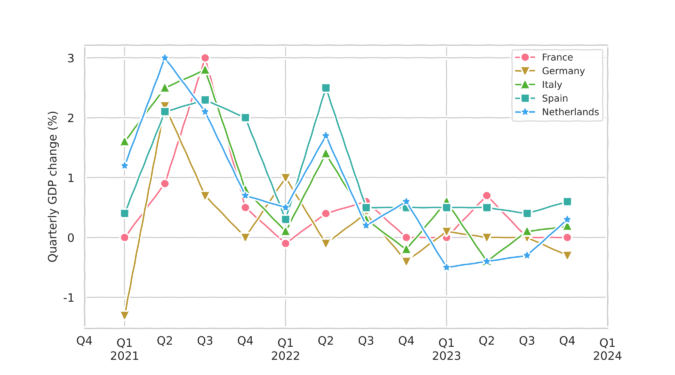

European Union

If we investigate further, the whole Eurozone stayed flat last year and fluctuated around the 0 mark, indicating stagnation. The list of recently worst-performing countries in Europe includes Iceland, Estonia, Moldova, Ireland, Romania, Finland, United Kingdom, and Luxembourg, out of which most are in a recession. It’s worth noting that Ireland, Estonia, and Luxembourg could be considered as specialized “tax havens” inside of Europe, enabling tax optimization. This would suggest some earning hiccups for businesses in these regions.

Special recognition goes to the top 5 European Union economies, in descending order relative to their contribution, namely Germany, France, Italy, Spain, and the Netherlands, corresponding to 67% of the entire EU.

The figure reflects the almost non-existent growth of the Eurozone. Surprisingly, Spain managed to maintain a low 0.5% growth throughout last year. On the other hand, the Netherlands was already in a technical recession but has since bounced back. Meanwhile, Germany seems to be heading towards recession as consecutive readings are in a declining trend. Recall that Germany is the biggest EU economy (24%) and the 4th world economy (4%). France stagnates around the 0 mark, with a slight spring growth.

Recently, it may not be popular to speak about in the mainstream, but in most of the biggest economies in the EU, farmers protested by blocking roads. This might not seem like a lot, but in the current outlook, any unrest and disturbance can affect the already struggling businesses.

China: The Sleeping Dragon or Nail to the Coffin

I will not dwell too much on this country, even though it is the 2nd largest global economy, contributing over 17%. It is essential to note that the reliability of Chinese economic data has been questioned in the past. Therefore, I will only mention what happened.

The most pressing issues in China are the housing market, issues with the collapse of the largest property developers, prolonged zero-COVID lockdowns, a global downturn affecting their exports, and wars around all their modern silk roads exacerbating crippling exports.

Even though China still shows stable economic growth for the entire 2023 in terms of GDP change, it has been experiencing deflation since the latter half of 2023. This rather indicates more bad than good news for China, and the rest of the world.

What Stats and Figures Will Not Tell You

Economic indicators like GDP or inflation are not static. They are constantly updated and revised as new data becomes available. These revisions can significantly change the initial figures, impacting the perception of the economy’s health.

Definition Changes Not Shown on Graphs

When economic indicators are revised, the underlying definitions and methodologies can change as well. These changes are not always reflected in the visualizations or summaries of the data, making it difficult for readers to fully grasp the implications of the revisions.

Revisions to GDP Metric

For instance, the UK’s Office for National Statistics revised the GDP metric in September 2023. This revision may have affected the interpretation of the data and the conclusions drawn from it.

Shadow Stats and Inflation

Additionally, consider alternative measures of inflation, such as the Shadow Statistics index, which tracks inflation using the old definition. Comparing these figures to the official inflation rate reported by the government can expose discrepancies.

Adjusting for Inflation: A Thought Experiment

Lastly, I want to offer a thought experiment that is not in line with what economists would typically say but will give you food for thought.

The change in GDP is the figure we were operating with, built on real GDP figures that do not consider inflation. If one would like to adjust for inflation, how would your outlook change on the global situation?

For example, the UK technically had growth of 0.1% in 2023 and official inflation of 4.2%. If we subtract them, we get a -4% shrinking of the economy, meaning what people and businesses collectively can acquire for their money. Applying a safety factor of 2, we get -2%. This is still worse than we are told.

Mind Your Own Business: Recession Preparation

I would rather stop questioning if we will go into a recession, but ask how strong, widespread, and long it might be here with us. Perhaps more appropriate is to ask: how can I prepare?

Preparing for a recession involves taking proactive steps to safeguard your finances and the potential well-being of yourself and your family. I would start by procuring some essentials, such as medication, extra long-life/dry food, and other necessities you require. Don’t freak out; it is in case of any other disruptions of supply chains.

Next, check your financials. Ensure you have a safety cushion by building an emergency fund that covers at least 3-6 months of living expenses. This fund can help you cover unexpected costs and provide a financial buffer during a recession. Additionally, review your budget and identify areas where you can cut spending beforehand. If the situation worsens, be prepared to make further cuts and adjustments. It’s worth considering reducing your risk with unnecessary credit, so pay it off.

By taking these steps, you can better position yourself to weather the economic downturn and emerge stronger on the other side. If you don’t have a budget and don’t know where to start, you can always check the SPENDSMART planner.

Closing Thoughts

As we navigate the complexities of the global economy, it is crucial to stay vigilant and keep a close eye on the markets. While the current economic data may not look that bad in most cases, it is essential to be aware of potential weaknesses and vulnerabilities in other economies.

At the same time, we remain cautious about significant financial decisions, such as buying a property. We are concerned about the risk of negative equity, especially when global economies are slowing down. We will continue to monitor the situation and make informed decisions.

While recessions can be challenging, they can also present opportunities for those who are prepared. By taking proactive steps to safeguard your finances and adjusting your financial plans accordingly, you can emerge stronger on the other side.

So, what are your thoughts? How will you prepare for a potential recession?